A VC fund for Georgia's thoroughbred companies

2019 brings the 10th year of GRA Venture Fund, a public-private VC fund investing exclusively in Georgia-based startups. In anticipation of the anniversary, Managing Director Kurt Jacobus shares his perspective on the Fund’s value to young companies – and to the people of Georgia.

When it was founded a decade ago, GRA Venture Fund was pretty unique.

That’s right – the model of having a state provide both fund capital and tax credits, matched 3-to-1 by private investors, was unheard of. It’s still unique today.

Why is the Fund important to Georgia?

The companies in our portfolio have a lot of promise and are doing really important work. They’re developing treatments for diseases, protecting us from threats, reducing energy usage and helping people and companies reach ambitious goals. So, some great opportunities to improve the human condition would be lost if we didn’t have the Fund. The investments we make come at a crucial early stage in the company’s life. They’re needed to help these companies develop and grow.

How do you define “early stage?”

We invest mostly at seed stage and Series A. That means we’ll take a look at just about anything that comes over the transom. That said, the startup companies in our portfolio generally have progressed beyond the most tentative first days, which are supported by angel investors and other seed capital providers, such as GRA’s venture development program. They’ve demonstrated great potential.

You’ve said that the Fund has an impact that’s broader than helping out a company.

And that impact is on the state itself. Having a diverse, technology-driven economy benefits everyone. The state benefits from payroll taxes and high quality of jobs. Beyond that, these employees buy houses and spend money here and raise families. It’s a virtual cycle, and it’s a long play.

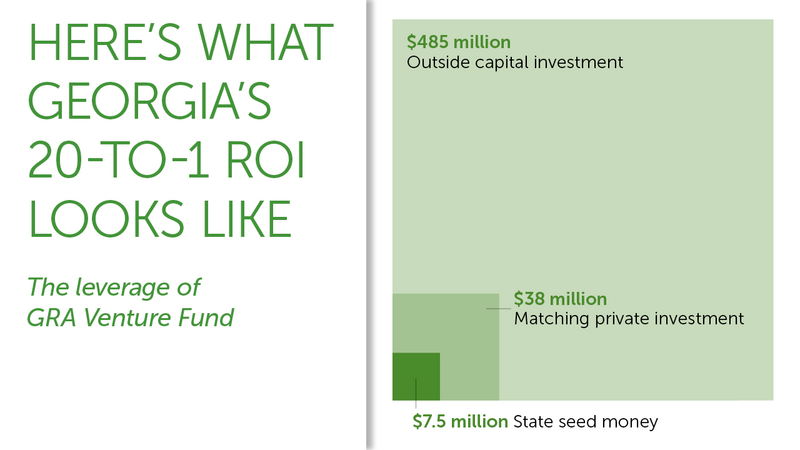

What’s been the return on investment so far?

To date, the Fund has invested $24 million, and we now have 14 active companies. Those companies have secured $485 million in outside capital. That’s 20-to-1 leverage. Think about that. For every dollar we invest from GRA Venture Fund, 20 more dollars flow into the state to support young enterprises.

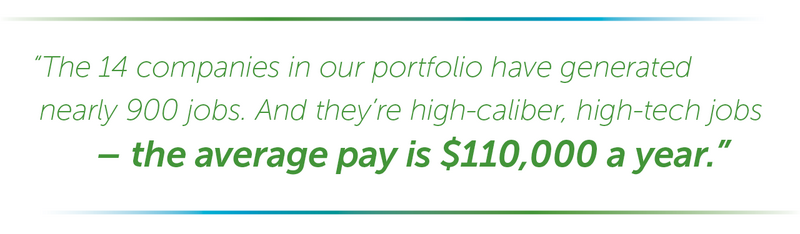

How does that translate into jobs created so far?

The 14 companies in our portfolio have generated nearly 900 jobs. And they’re high-caliber, high-tech jobs – the average pay is $110,000 a year. If you do the math, that’s $100 million in annual payroll obligations, which amounts to a $6 million check for Georgia every year in income tax collection alone. Considering the state’s only investment in the Fund was $7.5 million a decade ago, that’s a pretty incredible return.

Of course, some of those companies are bigger than others.

Yes, they’re further along in their development. Pindrop is a good example. They have about 120 people on payroll, so it’s not a small enterprise at all. It’s a cybersecurity play. Interestingly, one of the key people behind Pindrop’s launch, Mustaque Ahamad, has created a second enterprise, Fraudscope. It’s small – only eight or nine people on the payroll right now. But it has the DNA to do just as well as Pindrop.

How does a startup get the attention of the Fund? What do you look for?

For starters, we’re focused only on Georgia startups. But we’re sector agnostic – we will have a look as long as you’ve got a high-tech component to it.

For the best chance of securing investment, the technology would be affiliated with one of Georgia’s research universities, public or private. Standing behind it would be an excellent scientist, technologist or clinician who’s doing groundbreaking work. Finally, it’s ideal if the company has a good likelihood of attracting other venture capital.

These guidelines explain why most of the Fund’s investments have been made in companies first backed by GRA’s venture development program.

Exactly. GRA’s grant and loan program gives us a chance to take a close look at a company over time. That amounts to a higher degree of due diligence.

How much does the Fund typically invest?

It varies, but generally it’s about $500,000 on the first investment in a company. We also reserve generally $1 million to $1.5 million for a potential follow-on investment. So we feed the race horses but keep some hay in the barn to feed them again as they make their way around the track.

You’ve co-founded and grown a successful company, MedShape. What was the hardest part about that experience?

Developing a functioning sales channel. It’s hard work. That’s probably true for just about any early-stage enterprise, except for pharma startups, which have so many other development obstacles to overcome first.

Many would think a great product would sell itself. That’s not the case?

When you get into sales, you’re talking about the vagaries of human behavior, top to bottom. Most startup founders are technically oriented people They believe people know about superior products and buy superior products. But in most cases, people don’t know about superior products. And to try them, there’s always some hurdle they need to get over.

On top of that, they need that experience with the product or service to be really good if they’re going to say things to their peer groups about it. This can be unfamiliar water for technically oriented people, who are used to the laws of physics dictating outcomes.

What makes it so hard to navigate these waters?

When you’re small, for starters, it’s tough to get people to be aware of you. Just to get awareness, you’ve got to spend a lot of money. Then you have to have someone take a chance on your brand, which means selling past the inertia of someone who already has a product or service they like. You’ve to have a talented person to do that, and that person is expensive. Then you’ve got the expense of making sure the onboarding experience is just right.

All of this is for one account – and you need a certain number of accounts to get to scale. So it’s really like plugging holes in the dike with your fingers.

What’s the back story of your being selected as the new managing director of GRA Venture Fund?

I have a Ph.D. in engineering, and I joined McKinsey & Co. right out of grad school – it’s an ‘educational environment’ in that you’ve got to learn or you’re not going to make it. In my third year, I had the opportunity to do some pro bono work, and that was for GRA, in 2001.

What did you do?

I helped re-craft the strategy to accelerate the filling of Eminent Scholar positions and also helped shape the early-stage funding of startup companies, which ultimately materialized into the venture development program.

One of GRA’s founding members is Jim Balloun, who helped open the McKinsey office in Atlanta in the early ’80s and helped direct the team that led to the formation of GRA. Jim is an investor in MedShape as well, and last year he asked if I would consider doing some work with GRA Venture Fund. So I volunteered for the first half of 2018 and came aboard as Managing Director on July 1.

You’ve worn quite a few hats in your career – materials scientist, mechanical engineer, business consultant, CEO. Which hat best prepared you to direct a VC fund?

I’d have to say MedShape. We’ve endured just about every challenge under the sun for a startup. We’ve had moments of great difficulty and great prosperity. That’s allowed me to see the full development of a business – from, quite literally, an idea on a napkin to a very healthy enterprise. It’s enabled me to look at these young companies and help them prepare to fend off some of the things that challenge them. And at the same time, help them recognize that in any company’s lifetime, moments of success aren’t going to last forever.

What do you expect the years ahead to bring for the Fund?

Certainly, more opportunities to invest. We’ve funded deals that would not have been funded otherwise, so there’s a role for the Fund to continue to play in Georgia. We’ve got capital to deploy in the next few years, and after that, we’ve got to contemplate raising another fund.

One great advantage we have is that we’ve got a phenomenal team, not only our board, which is very savvy, but the professionals at GRA. While I feel like the work we’ve done has been important for Georgia, there’s a lot of potential to do more. We’re well prepared and positioned to make an even greater impact.