September 28, 2022

GRA venture program reaches $2 billion milestone

Careful investment, seasoned advice bring university projects from lab to market

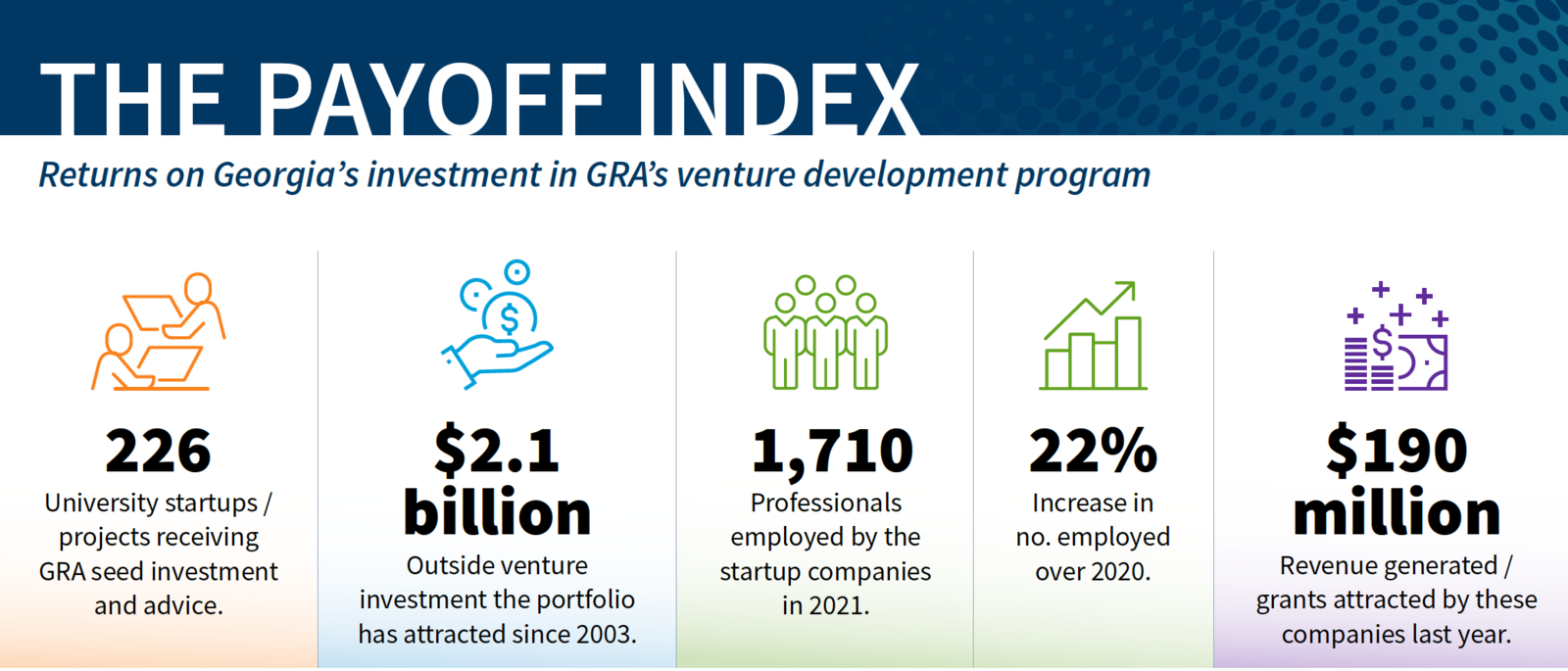

More than $2 billion in venture capital has flowed to a portfolio of Georgia startup enterprises formed around university inventions, according to data released this month from the Georgia Research Alliance.

The startups, all of which GRA helped to seed and shape since 2003, also showed a high survival rate: 88% were still in business four years after launch, compared to the national average of 44% in the same time period.

GRA’s venture development program helps researchers at Georgia’s universities bring their discoveries and inventions to market by providing seed grants and loans as well as business counsel. The Alliance, a nonprofit helping university scientists in Georgia do more research and start more companies, uses state dollars to make the investments.

According to the newly released 2021 data:

- 226 startups and projects are now in the GRA portfolio, an increase from 195 last year.

- The companies employ 1,710 professionals, a 22% increase over 2020.

- The companies also generated more than $153 million in revenue over the year and attracted more than $37 million in public and private grants.

- The additional outside investment from the year propelled the portfolio past the $2.1 billion mark in total investment since the program’s inception in 2003.

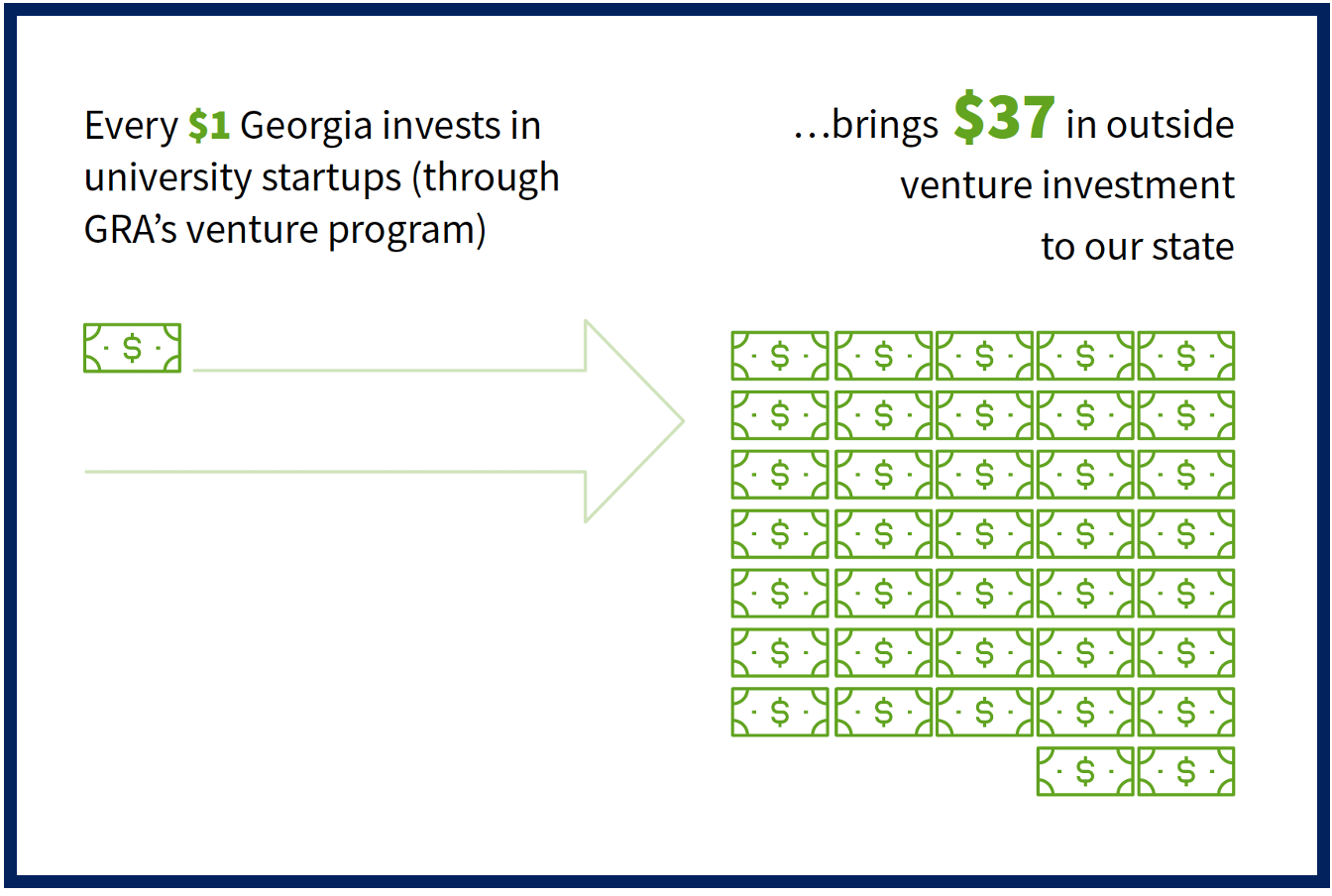

- Since 2003, every $1 Georgia invests in university startups (through GRA) has brought in $37 in outside venture capital investment.

“These latest figures reflect a tremendous return on the state of Georgia’s investment in university entrepreneurship,” says Susan Shows, GRA’s president. “While it’s crucial for Georgia to attract new industry to our state, it’s also important to propel the launch of new enterprises around promising university inventions.”

GRA’s investments take place at a very early stage, a point at which university researchers have shown a proof of concept and need to demonstrate market viability. Six out of 10 projects receiving GRA investment go on to become startup companies.

GRA’s investments take place at a very early stage, a point at which university researchers have shown a proof of concept and need to demonstrate market viability. Six out of 10 projects receiving GRA investment go on to become startup companies.

“We come in at a point in time when it’s extremely difficult for a new enterprise to attract outside investment,” Shows says. “But these success metrics reflect both the rigorous vetting process we apply as well as the counsel of our team of seasoned advisors.”

A three-person team at GRA has driven consistently strong returns from the program: Lee Herron, who now leads GRA’s Greater Yield initiative, which focuses on agtech startups; Ashley Cornelison, who leads the venture development operations; and Connor Seabrook, who manages GRA’s loan portfolio and serves as managing director of GRA Venture Fund, LLC.